child tax credit december 2021 amount

For the tax year 2021 significant adjustments have been made to the child tax credit. It helped roughly 60 million children and helped cut child.

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

The credit amount and the way parents get the credit are impacted by the two biggest changes.

. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules. Under the age of 6. These monthly payments and want to get the full.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. For 2021 eligible parents or guardians. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to.

November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in place for. Even though the advance child tax credit payments ended back in December theres more money on the way from the expanded child tax credit for parents to get with their 2021 tax refunds. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families.

A childs eligibility is based on their age on December 31 2021. Through December 2021. These people are eligible for the.

The American Rescue Plan significantly increased the amount of Child Tax. In December these families will receive a lump-sum payment of 1800 for younger children under six and 1500 for those between six and seventeen. The American Rescue Plan allowed for an increase in the Child Tax Credit for the 2021 tax year.

The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. This is up from the 2020 child tax credit.

In the months after the advance federal Child Tax Credit cash payments ended in December 2021 low-income families with children struggled the most to afford enough food. Increases the tax credit amount. Child Tax Credit update.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Have been a US. Increased from up to.

A childs age determines the amount. Families will be eligible to claim any Child Tax Credit amount they are eligible for over the amount of any monthly Child Tax Credit payments received last year when they file their 2021 tax. For any dependent child who is born or adopted in 2021 or who was not claimed on your 2020 return you are eligible to receive.

Put cash in your familys. The 2021 CTC is different than before in 6 key ways. Heres a look at the updates.

This was because the government did not know how many qualifying. Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children in the. If you did not file a tax return for 2019 or 2020 you likely did not receive monthly Child Tax Credit payments in 2021.

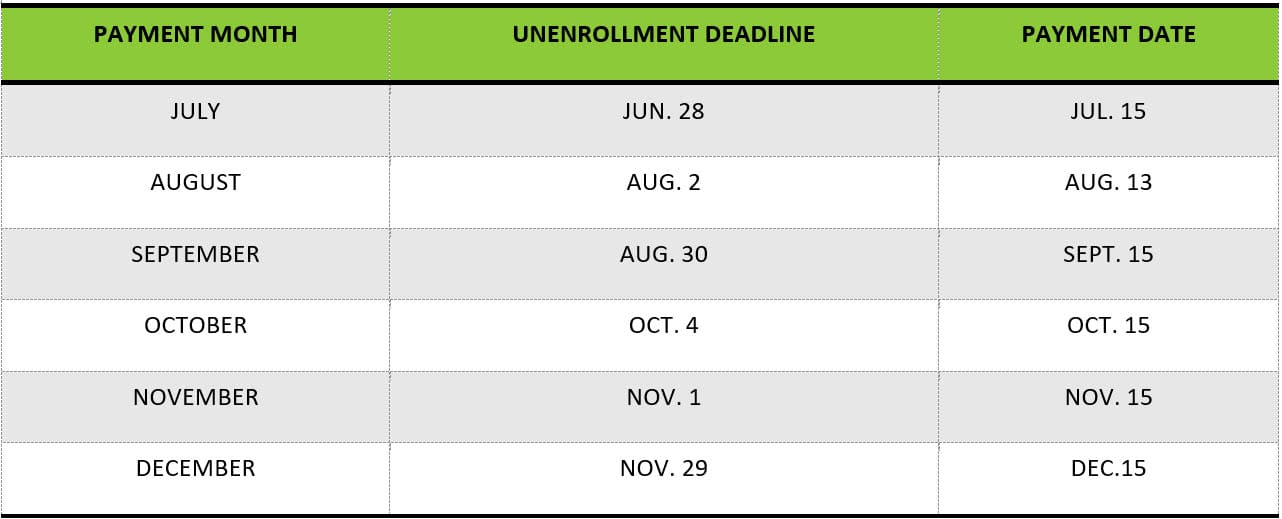

What Will be the. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. As part of the advance Child Tax Credit Congress temporarily raised the maximum child tax credits.

Nj 2021 Child Tax Credit Nj 211

Fact Sheet Advance Child Tax Credit

Child Tax Credit Advanced Payments Information Bc T

Up To 4 1 Million Households Still Owed 3 7 Billion In Stimulus Payments Is Yours One Of Them Al Com

Families Will Soon Receive Their December Advance Child Tax Credit Payment

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Dependent Children 2021 Tax Credit Jnba Financial Advisors

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Newsletter Monthly Payments Are On The Way To Hardworking Maryland Families Congressman Steny Hoyer

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Commentary Provisional Tax Credits Statistics December 2021 Gov Uk

Center For Siouxland It S Almost Time To File Your Taxes The Irs Is Sending Letters To Those Who Received Advance Child Tax Credit Payments And Or The 3rd Economic Impact Payment Aka

What To Know About The New Monthly Child Tax Credit Payments

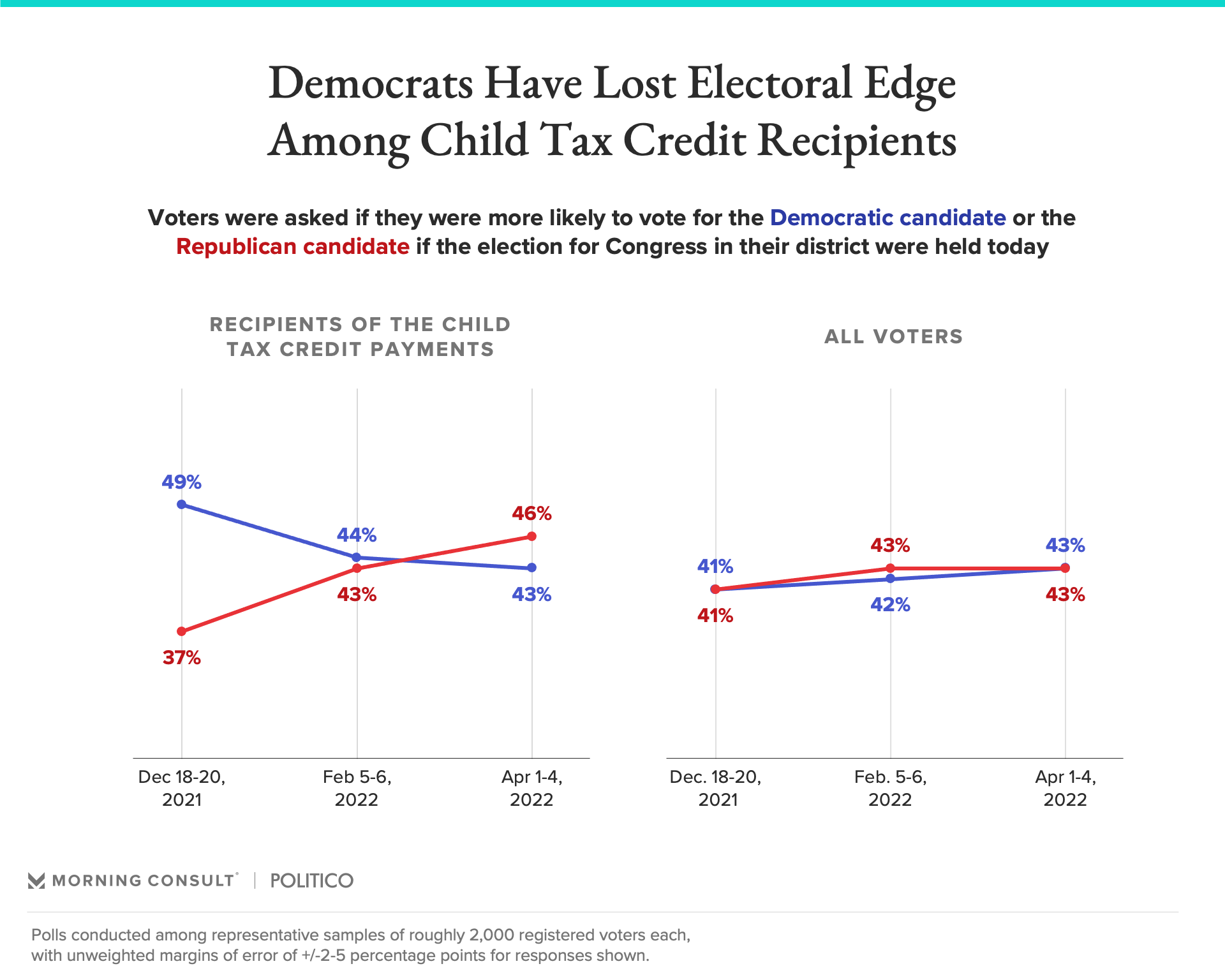

Republicans Favored To Win Senate Among Child Tax Credit Recipients

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All The Us Sun

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month Wgn Tv